Today, 25% of CTV Ad Inventory Can Only Be Purchased Via Linear TV

A version of this was originally featured on Adexchanger.

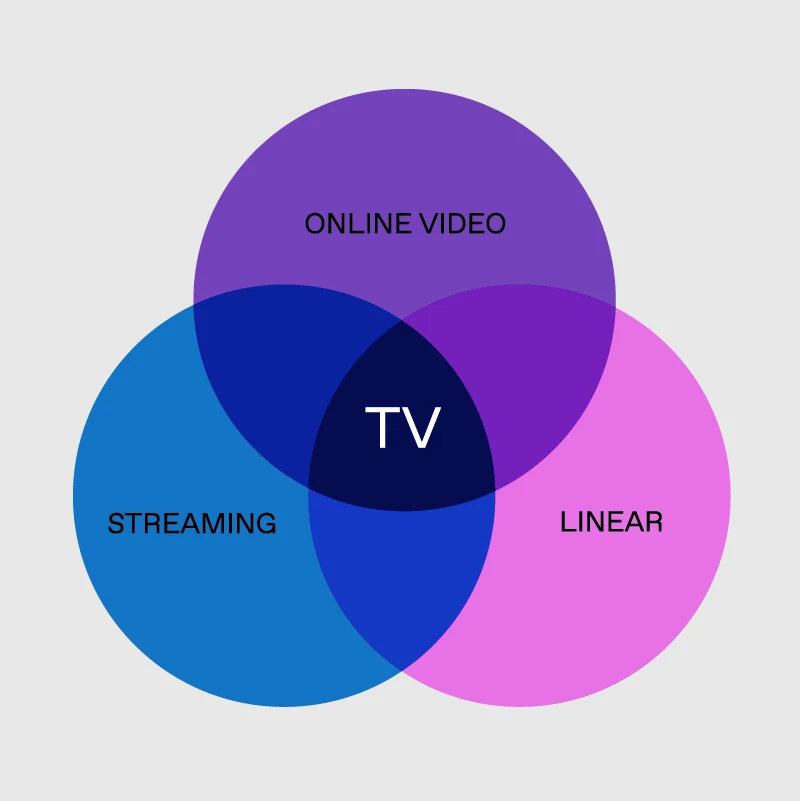

Streaming TV continues to get all of the attention from advertisers. Much of this excitement is coming at the expense of linear, which still commands close to more than half of all viewing. Amid this rush to buy up streaming inventory, many advertisers are missing some key points of differentiation about what gets labeled streaming, and what it actually means.

To many, content delivered via a platform like Amazon Prime automatically qualifies as “streaming.” But what about content delivered via a live feed, like Thursday Night Football? Nearly all viewers who watch will interact with the content via the live linear feed… which makes it much closer to linear content. Clearly, the terminology gets muddy when it comes to some of the content.

There is a similar muddiness when it comes to CTV advertising and how advertisers pursue the channel. CTV is now available in nearly 90% of U.S. households and takes up a third of viewing time, but only 40% of CTV audiences are exposed to ads in this environment.

Meanwhile, a significant amount of the inventory distributed to that 40% is actually sold via linear. This is especially prevalent with FAST networks, which currently accounts for 20-25% of ad-supported streaming as they grow in popularity among viewers and advertisers.

How can this be? Let’s examine a one-hour primetime program that airs on both linear TV and a FAST channel. This program has about 20 minutes of commercial time and 40 minutes of content. Those 20 minutes are divided further, with 18 minutes sold by the cable network (on a national basis), and the two remaining minutes sold by the cable network or MSO (such as Comcast or Charter) on a local basis.

For the FAST airing, which happens at the same time as the linear broadcast, the two minutes that went to the MSO are now handed over to the FAST platform to sell. With FAST platform, we mean the distributor of the content, typically either a virtual MVPD (e.g. YouTube TV, Sling, etc.) or a TV OEM (e.g. Roku Channel, VIZIO, etc.) Many folks in the ad industry would likely assume that the other 18 minutes of national ad time go to the FAST platform as well.

That is incorrect.

Those 18 minutes are actually the same 18 minutes of ads that the national network sold for its linear broadcast. So while all of this inventory is distributed as streaming to FAST viewers, it is sold as linear. To classify this as streaming, from an advertiser point of view, would be inaccurate.

In other words, to access the majority of inventory that runs against a program on a FAST platform, ad buyers would need to make linear purchases. If FAST is nearly one quarter of the ad-supported streaming market, then between 20 and 25% of all ad-supported streaming can only be purchased via linear. Some posit that more than 90% of all ad impressions delivered via CTV are actually in broadcast.

This example also shines a light on exactly how much “true streaming” inventory is actually available via the DSPs and platforms that promise to help connect advertisers with audiences. Those two minutes of inventory sold by the FAST platform represent a measly 10% of the inventory in the program.

Worse, it is often sold at CPMs 5x greater than what linear commands, for the same impression! Buyers who truly wanted to reach the audience watching the program would have a much better chance of engaging with their audience if they made the linear buy. In this case, that would give them the complete audience, not just the fraction watching via FAST.

This is one of many reasons why advertisers can’t trip over themselves in the rush to add more streaming inventory to their media plans. Linear still represents a great opportunity for reaching audiences in an efficient, affordable, high-performing way at scale, and there is a lot of inventory available to go around. Those who choose to cut off linear in the pursuit of streaming-only may be relegating themselves to fighting over 10% of all impressions while their competition finds a path to cost-efficient air time.

Philip Inghelbrecht

I'm CEO at Tatari. I love getting things done.

Related

As Linear’s Definition Gets Muddier, It’s Time to Talk ‘Convergent TV’

Are you caught in the debate over what constitutes streaming versus linear TV? Our latest blog dives into the blurred lines of the two advertising channels, advocating for a single categorization of convergent TV.

Read more

Breaking Down Convergent TV with LiftLab

Discover the current state of TV advertising and the emergence of TV streaming on a recent episode of Curve Your Enthusiasm with LiftLab and Philip Inghelbrecht.

Read more

Why Open Programmatic and CTV May Never Mix

In the evolving landscape of digital advertising, the intersection of open programmatic and connected TV (CTV) faces significant challenges.

Read more