Why Open Programmatic and CTV May Never Mix

A version of this was originally featured on ANA.

Programmatic ad buying took off in the 2010s because advertisers and publishers alike realized that audiences were splintering across the long tail of websites. As the monoculture dissolved, it became clear that it was impossible to reach a mass audience with direct buys and homepage takeovers across a dozen websites.

The result was a system that let advertisers reach consumers wherever they were on the web. At the same time, publishers could open up their inventory to thousands of buyers without having to manage infinite direct insertion orders.

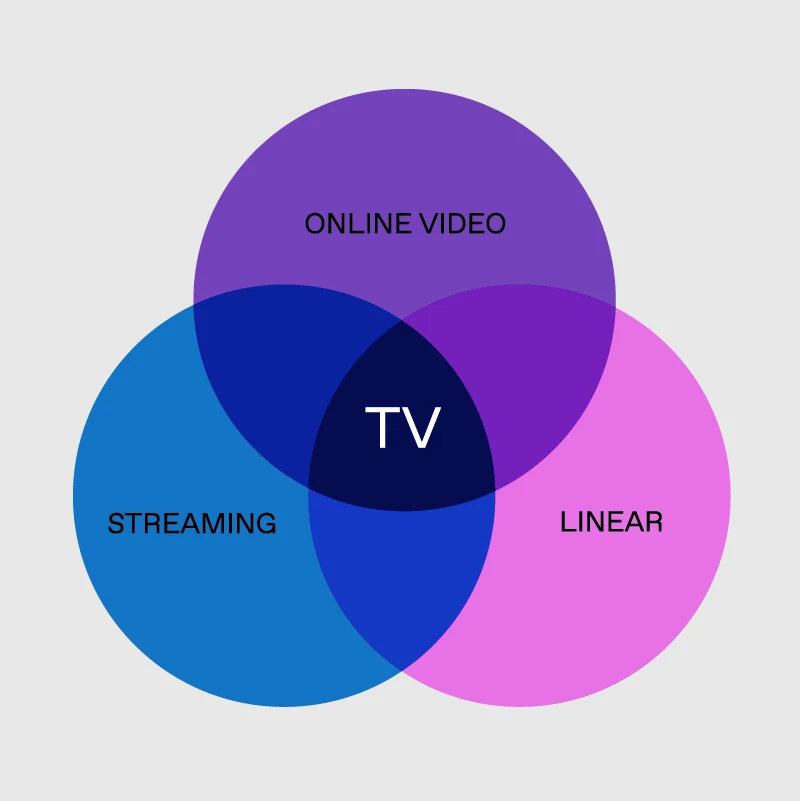

This is the primary way in which display advertising is bought and sold in 2024. At the same time, digitally connected convergent TV (CTV) is ascendent. Consumers are quickly adopting ad-supported streaming models, with hundreds of new free ad-supported TV (FAST) networks coming online in the past year. The result looks familiar: the death of a TV monoculture has led to the bifurcation of audiences across thousands of different channels, with thousands of advertisers looking to reach these viewers across these channels.

Programmatic seems like the likely solution once again, but new data reveals that a huge portion of every ad dollar spent via programmatic doesn’t actually reach the publisher who owns the ad space. A quarter of money spent on open web display inventory is straight-up waste. The reality is also such that only a small set of ~20 publishers will easily command 95% of all CTV impressions (i.e. unlike digital, where ad inventory is distributed across a seemingly infinite amount of sites).

As convergent TV becomes the dominant channel of the 2020s, advertisers are trying to decide whether to treat it like TV or like digital. The answer is a bit of both, but it requires a nuanced understanding of the benefits of both in the TV market.

Programmatic benefits

Open-market programmatic offers a handful of benefits. It provides easy and instant access to aggregated supply, which works well for small inventory buys or literally picking impression by impression. Advertisers can access hundreds of ad-supported channels without having to negotiate direct deals with each one.

Programmatic is also a necessary component of retargeting efforts that require finding a few impressions across a large set of publishers. It’s also just plain fast to set up, as many DSPs are ready to help brands connect with inventory.

There is, however, a big difference between “using programmatic technology to automate transactions” and “bidding on open market inventory in an auction environment”. Biddable Connected TV inventory is growing, but the best use case of programmatic in the space is to automate transactions that maintain a direct supply path (as attempted under the umbrella of “Supply Path Optimization,” or SPO). More on that below.

Programmatic issues push for a Direct solution (and not SPOs)

Of course, open-exchange programmatic has several well-known issues as well. Buying via the open web requires spending on viewability, brand safety, and other non-working fees (aka the Adtech tax). The latter can easily double the cost of a campaign (or from a publisher’s point of view: half the yield).

SPOs (short for Supply Path Optimizations) are no solutions to a convoluted supply chain, despite what the industry often touts. If we want to be frank, the way that most platforms practice SPO is fake direct (i.e. a programmatic deal with some volume discount).

True direct (and a truly smooth supply chain) requires an actual (technology!) connection between the buyer and the CTV publisher. Literally: from order to ad-server. No DSP, no SSP. Incumbents like TheTradeDesk recognize this (see Openpath). However, it’s nearly impossible to make this switch without sacrificing SSP partners. Look at Magnite, which was quick to launch its own version with Clearline, and in that, sacrificing TTD as the main DSP.

In the convergent TV space, programmatic’s benefit is not the open exchange of available inventory but in the infrastructure. Direct technology relationships can yield buyers' desired pricing and scale advantages (and solve fraud and brand safety in one fell swoop). Programmatic platforms have value, too, but at a much smaller scale (and higher cost), as outlined above).

Granularity Level | Advantages | Disadvantages |

High (Daily, Campaign-Level) | Detailed insights into campaign performance and day-of-week seasonality; can pinpoint specific drivers of success or failure. | Requires data that may not be available for all channels; increases complexity and potential for overfitting. |

Medium (Weekly, Channel-Level)* | Detailed insights into campaign performance and day-of-week seasonality; can pinpoint specific drivers of success or failure.Requires data that may not be available for all channels; increases complexity and potential for overfitting. Medium (Weekly, Channel-Level)*Balances detail with manageability; good for identifying trends, making strategic decisions, and long-term planning. | No insights into day-of-week seasonality; campaign-level metrics not available. |

Low (Monthly, Channel-Level) ** | Easier to manage and interpret; appropriate granularity for slow-to-change outcomes, like brand health/awareness. | Requires a much longer time series (i.e., many years of data); less responsive to quick changes. |

* Tatari-recommended granularity level for models focused on conversion outcomes

** Tatari-recommended granularity level for models focused on brand outcomes

Philip Inghelbrecht

I'm CEO at Tatari. I love getting things done.

Related

Tatari Awarded Best Connected TV Ad Platform

We are incredibly proud and excited to announce that Tatari has been named the Best Connected TV Platform at the 2024 Digiday Video & TV Awards.

Read more

Similar Inventory: Lookalike Modeling for TV Practitioners

Tatari’s Similar Inventory feature combines data science with viewership data in order to recommend available inventory across both linear and streaming TV. Watch our short video to learn more.

Read more

As Linear’s Definition Gets Muddier, It’s Time to Talk ‘Convergent TV’

Are you caught in the debate over what constitutes streaming versus linear TV? Our latest blog dives into the blurred lines of the two advertising channels, advocating for a single categorization of convergent TV.

Read more